Commercial vehicle electrification is an important transformation direction of the current global automotive industry, involving the upgrading of core parts of trucks, buses, special vehicles and other models.

The following is a comprehensive introduction to the electrification of commercial vehicle parts:

I. Core driving factors of commercial vehicle electrification

1. Policy and regulatory promotion

China's "dual carbon" goals (carbon peak in 2030 and carbon neutrality in 2060) promote the penetration rate of new energy commercial vehicles.

The EU's "Fit for 55" policy requires a 30% reduction in carbon emissions from commercial vehicles in 2030.

The U.S. Inflation Reduction Act (IRA) provides tax credits for electric commercial vehicles.

2. Improved economy

Battery costs are falling, and TCO (total cost of ownership) is gradually better than fuel vehicles.

Electricity costs are lower than diesel prices, there is no engine oil and gearbox loss, and maintenance costs are reduced by more than 40%.

3. Mature technology

Technologies such as high energy density batteries and 800V high-voltage fast charging have been implemented.

II. Electrification core components and technologies

1. Three-electric system (core incremental market)

Power battery - lithium iron phosphate (LFP) dominated, energy density increased to 180Wh/kg; sodium ion battery (commercial use in 2025

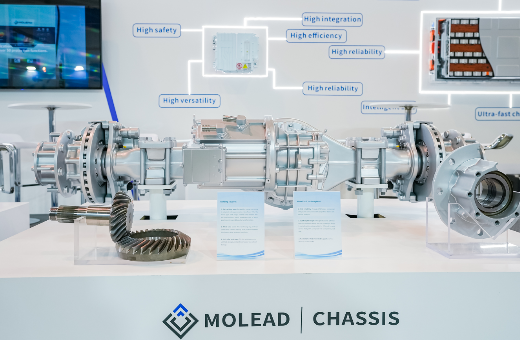

Electric drive system - integration (motor + electronic controller + reducer three-in-one); SiC (silicon carbide) devices improve efficiency

Electric control system - domain controller architecture (centralized management); intelligent energy recovery strategy.

2. Other key electrification components

Charging system: high-power liquid-cooled charging gun (350kW+), battery replacement mode (mainstream solution for heavy trucks, 5-minute battery replacement).

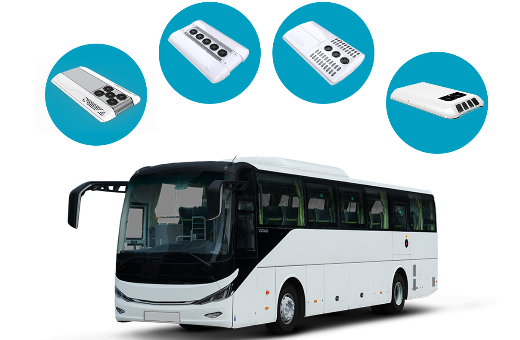

Thermal management system: battery liquid cooling/direct cooling technology (-30℃~60℃ wide temperature range operation).

Electric steering/braking: SBW and EBS replace hydraulic systems to support autonomous driving.

Lightweight body: aluminum alloy frame, composite cargo box (weight reduction of 20%+, improved endurance).

III. Current status of commercial vehicle electrification market

1. Vehicle penetration rate (2024)

Electrification rate of urban logistics vehicles 25%-30%, mainstream technical solution pure electric (NEDC 300km+)

Electrification rate of public buses 90%+, mainstream technical solution pure electric/hydrogen fuel cell

Electrification rate of heavy trucks 5%-8%, mainstream technical solution battery replacement (port/mining area), hydrogen fuel cell

2. Regional market characteristics

China: the world's largest market, policy-driven (such as "Blue Sky Defense"), battery replacement heavy trucks account for more than 50%.

Europe: Volvo, Scania and other automakers are fully electrified, focusing on hydrogen long-distance trucks.

North America: Tesla Semi and Nikola promote pure electric + hydrogen energy in parallel.

IV. Challenges and future trends

1. Current challenges

Battery life: High frequency use of commercial vehicles leads to fast battery degradation (replacement is required after 8 years).

Charging infrastructure: Low coverage of heavy truck fast charging stations (only 2,000+ stations have been built in China).

Cost pressure: The price of electric trucks is still 30%-50% higher than that of fuel vehicles.

2. Future Trends (2025-2030)

Commercialization of solid-state batteries: Energy density exceeds 400Wh/kg, solving range anxiety.

V2G (vehicle-grid interaction): Commercial vehicles participate in grid peak regulation as energy storage units.

Autonomous driving + electrification synergy: Unmanned truck fleets reduce logistics costs.

Commercial vehicle electrification is shifting from policy-driven to market-driven, and the technological iteration of core components (such as batteries, electric drives, and thermal management) will determine the industry's progress.

Molead has always focused on the entire industrial chain of commercial vehicles, with core products covering air conditioners, axles, suspensions, seats, electronics, and interior and exterior trims. After over 20 years of rapid growth, we have become one of the largest commercial vehicle parts groups, integrating R&D, manufacturing, and sales. Our annual output reaches 100,000 sets of parts and components, with sales exceeding USD 1.3 billion in 2024.

If you has any questions about our products and service, please feel free to contact us.

Email: marketing@molead.com

Mobile: +86 18736032501

China

China English

English French

French Spanish

Spanish Russian

Russian